Silicon carbide is a hot topic in the power electronics field these days. As a recent article in the New York Times explains, SiC is a wide-bandgap (WBG) material that designers are increasingly choosing to make power electronics devices more efficient.

WBG advantages

The WBG classification has profound implications for device behavior and performance. This is because the term bandgap describes how difficult it is to get a material to conduct electricity without having to ionize it first (that is, turn it into plasma). More specifically, it is a measure of the amount of energy (given in electron-volts, or eV) that it takes to promote an electron in the outermost valence of an atom to what is called the conduction band (hence the term bandgap). The bandgap energy of metals is effectively 0 eV, so they are good conductors—electrons can easily pop out of the outer valence to the conduction band or vice versa—whereas materials with a bandgap energy of around 4 eV or higher are considered to be insulators. Materials with a bandgap energy between those two extremes are, of course, considered semiconductors, with an approximate value of 1.14 eV for Si, 2.3 to 3.3 eV for SiC and 3.4 eV for gallium nitride, or GaN—another popular new option for various power electronics applications.

You might be thinking: Aren’t WBG materials like SiC and GaN at a disadvantage compared to Si simply because they are much closer to being insulators than conductors? No. While it is true that a SiC or GaN device with a given die area and thickness will exhibit a higher bulk resistivity (and therefore on-resistance) than a comparable Si device, the wide bandgap means their dice can be much thinner for the same voltage rating. The thinner dice have lower on-resistance, and lower thermal resistance too. Another related advantage to a WBG is that leakage current starts off lower and increases much more slowly with a rise in temperature (in more technical terms, the spontaneous generation of charge carriers from heat is reduced). These materials can also withstand higher operating temperatures (even if their die attach solder or packaging can’t!), which, when combined with the lower leakage and thermal resistance, means they can handle a lot more power for a given device size.

Growing popularity

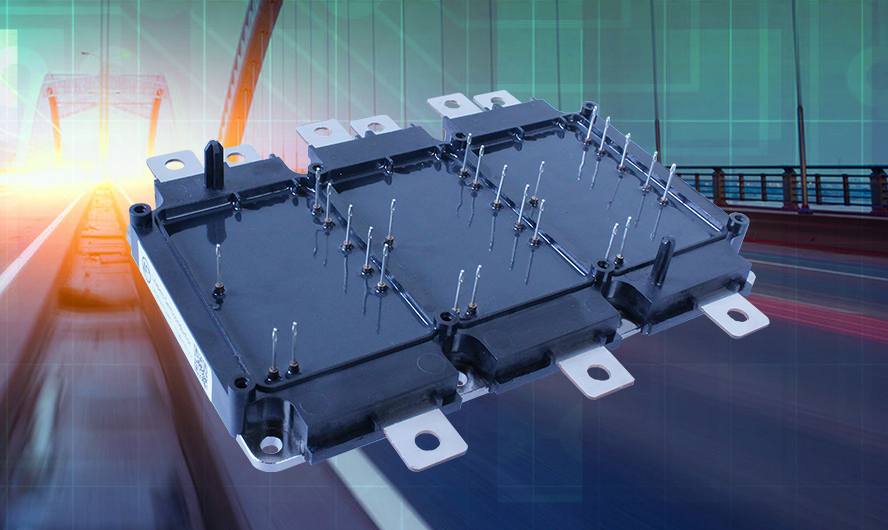

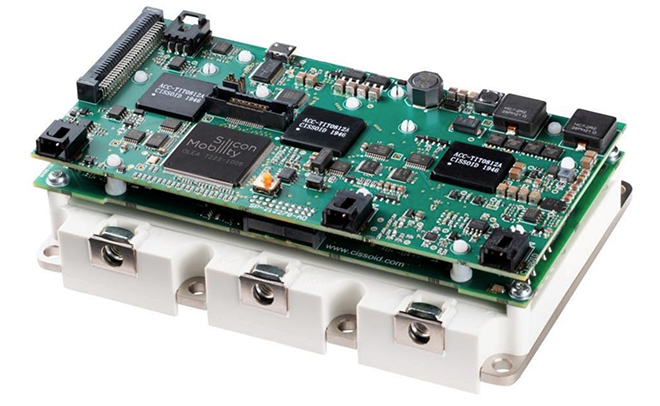

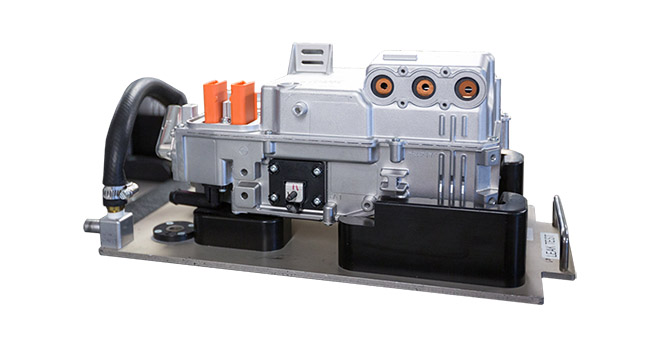

Tesla was an early adopter of silicon carbide-based semiconductors—in 2017, it used them in the Model 3’s traction inverters. STMicroelectronics, the supplier of Tesla’s SiC chips, claimed that they could increase a vehicle’s range by up to 10 percent while also delivering significant space and weight savings.

“The Model 3 has an air-resistance factor as low as a sports car’s,” Masayoshi Yamamoto, a Nagoya University engineer and EV teardown expert, told Nikkei Asia (via the New York Times). “Scaling down inverters enabled its streamlined design.”

“We wouldn’t have had such a boom of electric vehicles without silicon carbide,” said STMicroeletronics executive Edoardo Merli.

Silicon carbide costs much more than boring old silicon, but for some manufacturers, the benefits more than justify the higher price. According to the Times, some automakers are planning to use silicon carbide not only in inverters, but in other electrical components such as DC/DC converters and on-board chargers.

Semiconductor manufacturer Wolfspeed recently opened a $1-billion silicon carbide fabrication plant in upstate New York. Material produced at the new fab is destined for customers including General Motors. EV buyers “are looking for greater range,” GM VP Shilpan Amin told the Times. “We see silicon carbide as an essential material in the design of our power electronics.”

Silicon is expected to continue to dominate the half-trillion-dollar semiconductor industry, but SiC is finding an important niche in power electronics, which are critical for EVs, and currently make up a market of about $20 billion per year. Yole Développement projects that the automotive market for silicon carbide will increase from $1 billion to $5 billion by 2027.

Silicon carbide has been under development as a transistor material for decades. More recently, engineers have started using newer WBG materials such as gallium nitride, in power electronics. Yole Développement estimates that the gallium nitride market will grow from its current annual value of around $200 million to $2 billion by 2027.

According to the Times, many companies expect gallium nitride to eventually replace silicon in solar and wind inverter applications. “It’s the end of the road for silicon,” said a senior Enphase engineer in an investors’ meeting last year.

Sources: New York Times, Jeffrey Jenkins (Charged Tech Editor)